Recently, TechCrunch published an article, “AI is too risky to insure, say people whose job is insuring risk.” Needless to say, we have some thoughts about it.

While the TechCrunch article highlights the insurance industry’s concerns about AI’s unpredictability and systemic risk, it’s crucial to recognize that in sensitive, highly regulated sectors like insurance, the primary value of AI is not speed—but accuracy, reliability, and explainability.

AI Is More Than Just Latency

The recent TechCrunch article, “AI is too risky to insure, say people whose job is insuring risk,” raises valid concerns about the challenges of underwriting AI-related risks. Insurers are right to be cautious about black-box models and the potential for systemic failures. However, the discussion often overlooks a fundamental truth: in industries like insurance, AI’s greatest impact comes not from how fast it operates, but from how accurately and transparently it can support critical decisions.

We believe that accuracy is the baseline for any AI system deployed in regulated environments. In insurance, where decisions affect livelihoods, compliance, and financial stability, the cost of an inaccurate or opaque AI output far outweighs any benefit gained from faster processing alone.

Why Accuracy Matters Most in Insurance

1. Risk Assessment and Underwriting

AI models are transforming insurance underwriting by analyzing vast, complex datasets to deliver more precise risk profiles. For example, insurers using explainable AI platforms have improved both the accuracy and transparency of their pricing and risk models, directly addressing regulatory and audit requirements.

In practice, deep learning models for vehicle damage assessment have achieved up to 99.4% accuracy, reducing human error and ensuring fairer outcomes for policyholders.

2. Claims Processing

Leading insurers have piloted AI systems that process claims with 98% accuracy, matching or exceeding human performance. This not only streamlines operations but also ensures that claims are handled consistently and justly.

3. Fraud Detection

AI-driven fraud detection systems have enabled insurers to identify up to three times more fraudulent activity than traditional methods, minimizing false positives and protecting both the company and its customers.

4. Regulatory Compliance

Regulatory bodies now require that AI systems be explainable, auditable, and fair. Insurers must demonstrate that their models do not introduce bias or make unexplainable decisions—making accuracy and transparency non-negotiable.

AI Accuracy Table

| Use Case |

AI Accuracy Achieved |

Impact/Outcome |

| Claims Processing |

98% |

Reduced errors, improved consistency |

| Vehicle Damage Estimation |

99.4% |

Fairer, more reliable assessments |

| Fraud Detection |

3x more fraud found |

Fewer false positives, better risk management |

Addressing the “Black Box” Concern

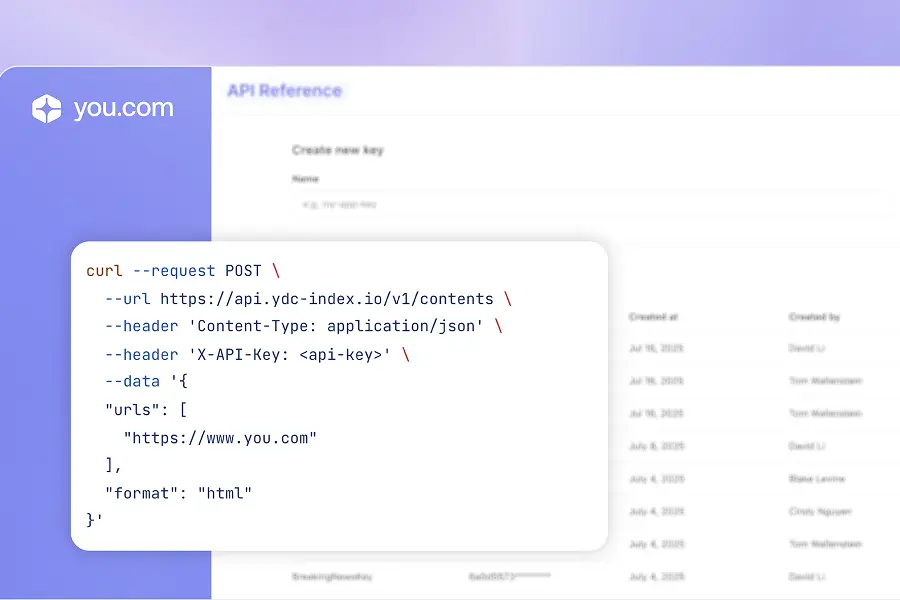

The TechCrunch article rightly points out that insurers are wary of AI’s “black box” nature. At You.com, we tackle this head-on by prioritizing explainability and transparency in every AI deployment. Our enterprise AI agents are designed to provide citation-backed, auditable answers—empowering insurers to understand, trust, and validate every decision.

Beyond Insurance: A Broader Industry Standard

This focus on accuracy isn’t unique to insurance. In healthcare, finance, and legal sectors, regulatory frameworks demand that AI systems be accurate, explainable, and reliable. For example:

- Finance: AI-driven credit and fraud models are subject to rigorous validation and must be explainable to regulators.

- Legal: AI document analysis tools must ensure compliance and avoid introducing legal risk through errors.

- Healthcare: AI diagnostic tools must match or exceed clinician accuracy and provide clear audit trails.

You.com’s Commitment: Accuracy, Reliability, and Trust

At You.com, we’ve built our platform to meet the highest standards of accuracy, security, and compliance. Our enterprise AI agents are:

- Benchmark-leading in accuracy for complex, real-world business queries.

- SOC 2 certified and designed for zero data retention, ensuring data privacy.

- Customizable and transparent, allowing insurers to tailor AI to their unique workflows and regulatory needs.

Make AI Work for Your Org

The insurance industry’s caution around fast AI is understandable, but the solution is not to avoid AI altogether—it’s to demand and deploy AI that is accurate, transparent, and reliable. In regulated industries, speed is only valuable when paired with uncompromising accuracy and explainability. The future of AI in insurance—and beyond—depends on building systems that are not just fast, but fundamentally trustworthy.

We’re committed to delivering AI that meets these standards, empowering insurers to manage risk confidently and compliantly in a rapidly evolving landscape. To learn more, book a demo.

.webp)

.png)

.png)

.png)