November 25, 2025

In Insurance, AI’s True Value Is Accuracy—Not Just Speed

Featured resources.

Paying 10x More After Google’s num=100 Change? Migrate to You.com in Under 10 MinutesPaying 10x More After Google’s num=100 Change? Migrate to You.com in Under 10 Minutes

.webp)

Paying 10x More After Google’s num=100 Change? Migrate to You.com in Under 10 Minutes

September 18, 2025

Blog

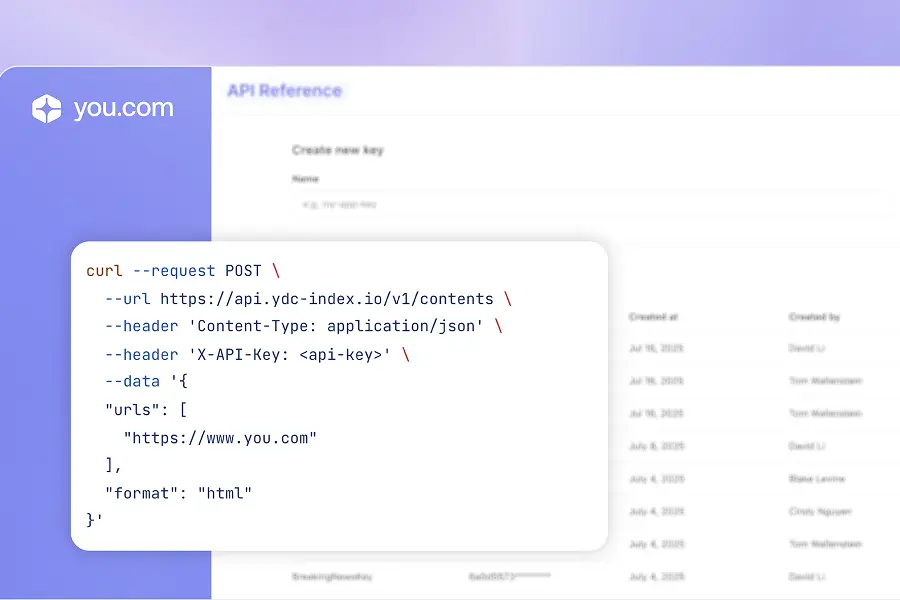

September 2025 API Roundup: Introducing Express & Contents APIsSeptember 2025 API Roundup: Introducing Express & Contents APIs

September 2025 API Roundup: Introducing Express & Contents APIs

September 16, 2025

Blog

You.com vs. Microsoft Copilot: How They Compare for Enterprise TeamsYou.com vs. Microsoft Copilot: How They Compare for Enterprise Teams

You.com vs. Microsoft Copilot: How They Compare for Enterprise Teams

September 10, 2025

Blog

All resources.

Browse our complete collection of tools, guides, and expert insights — helping your team turn AI into ROI.

Semantic Chunking: A Developer's Guide to Smarter RAG DataSemantic Chunking: A Developer's Guide to Smarter RAG Data

Rag & Grounding AI

Semantic Chunking: A Developer's Guide to Smarter RAG Data

February 19, 2026

Blog

4 AI Use Cases in Retail That Demonstrate Transformation4 AI Use Cases in Retail That Demonstrate Transformation

AI Agents & Custom Indexes

4 AI Use Cases in Retail That Demonstrate Transformation

February 18, 2026

Blog

The Forward-Deployed Engineer: What Does That Mean at You.com?The Forward-Deployed Engineer: What Does That Mean at You.com?

AI Agents & Custom Indexes

The Forward-Deployed Engineer: What Does That Mean at You.com?

February 17, 2026

Blog

What is n8n? A Beginner's Guide to Workflow AutomationWhat is n8n? A Beginner's Guide to Workflow Automation

Modular AI & ML Workflows

What is n8n? A Beginner's Guide to Workflow Automation

February 13, 2026

Blog

Bryan McCann on Productivity, Proactivity, and the AI-Powered WorkforceBryan McCann on Productivity, Proactivity, and the AI-Powered Workforce

AI Search Infrastructure

Bryan McCann on Productivity, Proactivity, and the AI-Powered Workforce

February 12, 2026

Blog

What Is a Web Crawler in a Website and How Does It Differ From a Search API?What Is a Web Crawler in a Website and How Does It Differ From a Search API?

AI 101

What Is a Web Crawler in a Website and How Does It Differ From a Search API?

February 11, 2026

Blog

The Most Popular Agentic Open-Source Tools (2026 Edition)The Most Popular Agentic Open-Source Tools (2026 Edition)

AI Agents & Custom Indexes

The Most Popular Agentic Open-Source Tools (2026 Edition)

February 9, 2026

Blog

AI Agents Are Entering the Workforce, Is Your Data Ready?AI Agents Are Entering the Workforce, Is Your Data Ready?

AI Search Infrastructure

AI Agents Are Entering the Workforce, Is Your Data Ready?

February 6, 2026

Blog